Anyone who lives, works, invests or owns property in Spain increasingly has to deal with digital government services. Taxes, social security and many administrative procedures are now handled almost entirely online. In all these cases, you need some form of digital identification or electronic signature.

In Spain, there are two main systems for this purpose: Cl@ve and the digital certificate (FNMT). Although they are often mentioned together, they serve different purposes and are not equally suitable for everyone. In this article, we explain the differences and which option best fits your situation in practice.

What is an electronic signature?

An electronic signature (firma electrónica) is the digital equivalent of a handwritten signature. It allows you to identify yourself online and to sign documents with full legal validity. Without an electronic signature, many administrative procedures require physical appointments, which are often time-consuming and impractical.

In Spain, an electronic signature is used for, among other things:

-

- tax returns and communication with the tax authorities (Hacienda)

- matters related to social security (Seguridad Social)

- administrative procedures with public authorities

- signing official documents related to tax, legal and real estate matters

Cl@ve and the digital certificate: two systems, two purposes

The Spanish government uses several systems for digital identification. The best-known are Cl@ve and the digital certificate (FNMT). Each has its own purpose and level of convenience, but they are not equally suitable for all users..

- Cl@ve: digital access for day-to-day administration

Cl@ve is designed as a user-friendly system for everyday administrative tasks. It is mainly intended for logging into government portals and handling basic procedures.

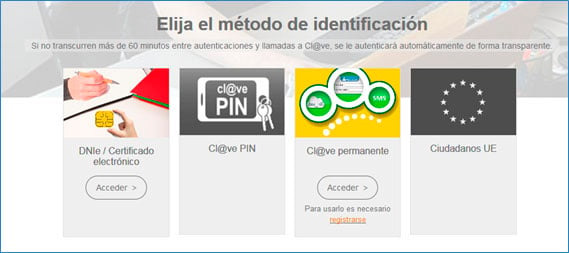

Cl@ve exists in several forms:

-

-

- Cl@ve PIN

A temporary code sent by SMS or via the Cl@ve app. This PIN is valid for a short time and is often used for occasional procedures. - Cl@ve Permanente

Permanent login credentials with an additional security step, intended for users who interact regularly with public services.. - Cl@ve Móvil (app)

Login via confirmation on your smartphone, without having to manually enter codes.

- Cl@ve PIN

-

Cl@ve is widely used for services of the tax authorities, social security and certain Extranjería platforms. In practice, Cl@ve works best for Spanish citizens and residents with recent documentation. For foreign users without a Spanish DNI, activation can be challenging, especially with older NIE or residence documents.

An important point of attention is that your phone number must be registered with Hacienda. If this is not the case, Cl@ve PIN will not work.

Additionally, Cl@ve is not sufficient in all situations. For more formal or legal procedures, it is not always accepted.

Note: Cl@ve is comparable to systems such as DigiD in the Netherlands, itsme® in Belgium or FranceConnect in France. These are all digital identities that allow citizens to access government services. As in other European countries, these systems are mainly intended for access and identification. For legally binding actions and digital signatures, an additional system is usually required. Spain is relatively strict in this respect: for tax, real estate and notarial matters, a digital certificate is often mandatory..

- The digital certificate (FNMT): maximum legal validity

The FNMT digital certificate is the most complete and powerful form of electronic identification in Spain. It allows you to identify yourself digitally and to sign documents with full legal validity.

The digital certificate is used for:

-

-

- tax returns and fiscal procedures

- legal and notarial actions

- real estate transactions and powers of attorney

- long-term and formal administrative files

-

A major advantage is that the certificate is also available to non-residents and foreign residents without a Spanish DNI, provided they have a valid NIE. In practice, this makes it the most reliable solution for foreigners.

Have your lawyer or gestor with your digital certificate

An additional advantage of the digital certificate is that it allows a lawyer, gestor or advisor to act on your behalf. The certificate can be securely installed on their system, enabling them to carry out administrative and legal procedures entirely in your name.

This is commonly used for:

-

- tax filings and communication with Hacienda

- real estate and notarial procedures

- Extranjería files (foreigners, expats, residents)

- long-term administrative processes

For those who do not permanently reside in Spain, this is a major practical benefit. Your files are handled correctly without you having to log in or be physically present each time. Naturally, this should only be done with a trusted professional, as the digital certificate grants full representation powers.

When should you choose Cl@ve and when a digital certificate?

In broad terms:

Cl@ve is suitable if:

-

- you are resident in Spain

- you mainly handle simple administrative matters

- you want quick and easy access to government services

The digital certificate is recommended if:

-

- you deal with tax, legal or real estate matters

- you want to digitally sign documents with full legal validity

- you do not have a Spanish DNI

- you or your advisor work regularly with Spanish authorities

For many foreigners, the digital certificate therefore proves to be the most versatile and future-proof choice.

How do you apply for an electronic signature?

There are several ways to obtain an electronic signature. The best route depends on your situation, your documents and whether you are present in Spain.

• Do it yourself via official authorities

You can apply for both Cl@ve and the FNMT certificate yourself via government websites. This requires correct documentation, technical installation and sometimes in-person identification. For those familiar with the Spanish system, this is feasible, but for foreign users it can be complex and time-consuming.

• With a physical appointment in Spain

If you are already in Spain, identification can sometimes be arranged in person at a municipality or other government office. Be aware of limited opening hours and possible waiting times. Basic knowledge of Spanish is a clear advantage.

• Fully online with professional guidance

For non-residents, foreign residents without a DNI and people with older documents, a guided online application is often the most efficient solution. You are assisted step by step in obtaining the digital certificate, without unnecessary travel or technical pitfalls.

CONCLUSION

Both Cl@ve and the digital certificate play an important role in Spain’s digital administration. Cl@ve is useful for everyday, simple procedures and is mainly used by residents. The digital certificate, on the other hand, offers maximum legal validity, flexibility and the possibility to work through a lawyer or gestor, which in practice often makes it the best choice for foreign users.

.png?width=774&height=322&name=oficina%20%20kantoor%20IMMOFY%20(2).png)